Slumberland cuts health plan costs by half

Decreases employees’ out-of-pocket costs 68%

Customer case study

The Challenge

Employee turnover in the retail industry is a problem. Slumberland needed a health plan with price clarity and a broad provider network that could help attract and retain employees while allowing the company to remain cost conscious and stay competitive.

The Solution

Slumberland surveyed the market and discovered that the Surest plan offered something different — an engaging consumer experience, cost clarity and the broad UnitedHealthcare Choice Plus provider network. The Surest plan saved the company and employees money and provided price transparency, fewer restrictions and ease of use.

The Outcome

Employee impact in 2021

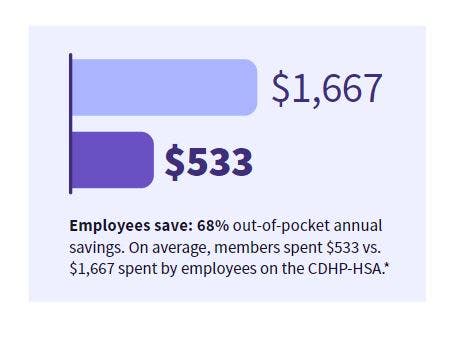

- Employees save: 68% out-of-pocket annual savings. On average, members spent $533 vs. $1,667 spent by employees on the CDHP-HSA.1

- Employees engage: In 2021, 79% of members with a claim (claimants) interacted with Surest via the app or Surest Member Services. 68% of member households overall (claimant and non-claimants combined) interacted with Surest.

Employer impact in 2021

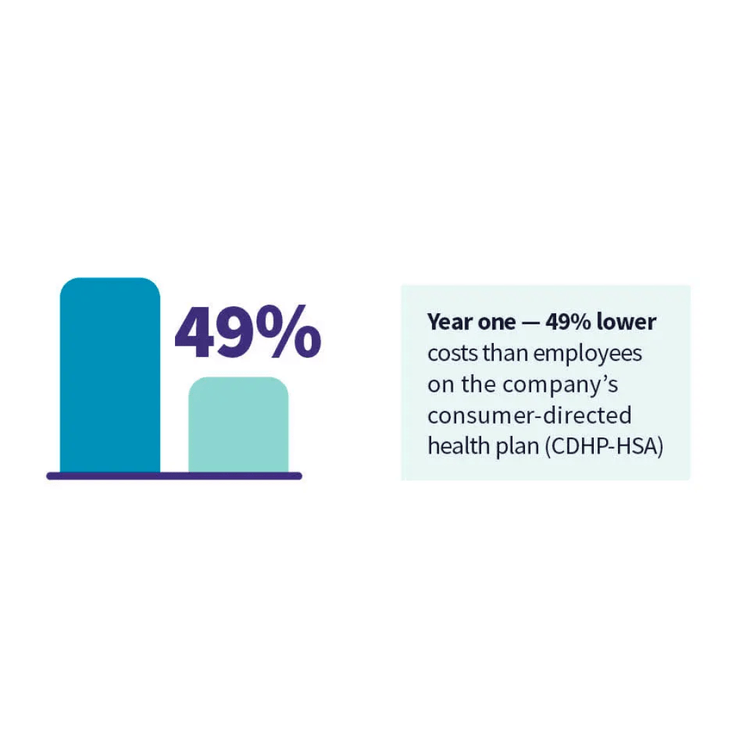

- Year one — 49% lower costs than employees on the company’s consumer-directed health plan (CDHP-HSA)

- Year two — 54% lower costs than CDHP-HSA participants

“I love not having a deductible. Trips to the doctor are set prices I know in advance.”

-Slumberland Employee

“By year three, we eliminated our other health plan and offered only Surest. There was zero negative feedback. Employees and the company have been absolutely thrilled with the Surest experience. When is the last time your employees thanked you for the medical plan? We can honestly say we hear it often, which benefit professionals know is rare.”

- Lisa Tepley, Sr. Benefits Manager, Slumberland

1 Compared to members in a CDHP-HSA comparison group matched by gender, age and geography.